Challenge:

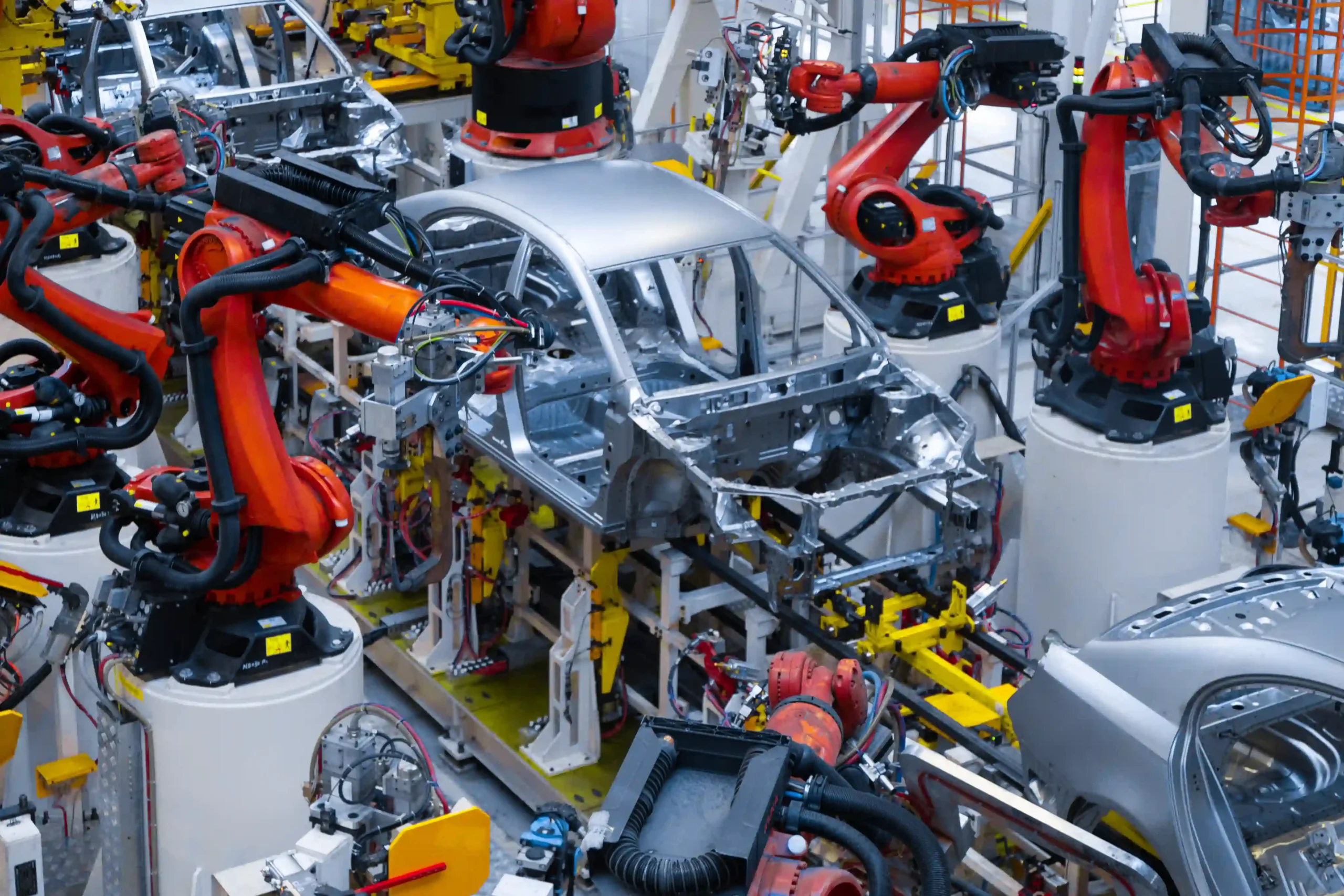

A leading manufacturer operating across the UK and EU required expert customs support to manage its Inward Processing Relief (IPR) activity. The business faced increasing complexity around compliance, documentation accuracy, and maintaining its IPR authorisations.

Relying on parcel operators risked the loss of IPR status, which could lead to unnecessary duties and taxes. The company needed a specialist partner capable of ensuring full HMRC compliance while maintaining uninterrupted production and international trade.

Solution:

The manufacturer appointed C4 Logistics as its dedicated customs agent for all UK and EU operations.

Through our Customs Office, C4 manages the entire IPR flow, from import and re-export to authorisation transfers and free-circulation clearances. Our expert team worked closely with each site to review and align processes with HMRC standards, providing complete visibility and control over every declaration.

Result:

Since transitioning to C4 Logistics, every site has been successfully audited and approved by HMRC, confirming full IPR compliance. The company now benefits from efficient, transparent customs management, ensuring business continuity and avoiding unnecessary tax exposure.

By combining precision, regulatory knowledge, and proactive support, C4 Logistics enables manufacturers to protect their IPR status and trade confidently across borders.